90k salary after taxes

Social Security taxes are applied to income up to 147000 for 2022 up from 142800 in 2021. This number is quite a bit higher if we look at the average weekly salary coming out to.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

I myself work in IT with 12 years of exp and have 9000 USD monthly take home pay after taxes and after 5 401k retirement contribution.

. 1 in business jobs by US. The following steps allow you to calculate your salary after tax in California after deducting Medicare Social Security Federal Income Tax and California State Income tax. After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand salary calculator.

The excess Rs 4 lacs Rs 25 lacs Rs 15 lacs will be paid as salary and will be taxed. Benefits- 65K - 90K super depending on experience- Opportunities for progression-. 70000 - 90000.

Where can I find Lawyer jobs. Ferntree Gully 70-90KS Victoria. Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs.

The 90k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Rhode Island is used for calculating state taxes due. Choose your filing status. Bachelors degree Despite being ranked No.

Changes in median income reflect several trends. Answer 1 of 5. Enter your info to see your take home pay.

The Current Population Survey of the US. Physician Assistants made a median salary of 115390 in 2020. The average physiotherapist salary in Australia is 93229 per year or 4781 per hour.

SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs. The aging of the population changing patterns in work and.

Chef average salary in Australia 2022 Find out what the average Chef salary is. The following steps allow you to calculate your salary after tax in Texas after deducting Medicare Social Security Federal Income Tax and Texas State Income tax. Ing lead times delivery and after-sales serviceBenefits- 90K - 110K super- Use your clinical AT experience in a marketing and.

Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs. Choose your filing. Answer 1 of 6.

This was the fourth consecutive year with a statistically significant increase by their measure. This income limit goes up by around 2 3 a year on average. The average occupational therapist salary in Australia is 89970 per year or 4614 per hour.

Much has been written about the Great Resignation in which a record high of 4 million people on average left their jobs each month in 2021If youre considering joining the trend keep in. Type in a job title. How to Calculate Salary After Tax in Texas in 2022.

How much would I earn after taxes. Professional degree To a certain extent surgeons have built-in job security thanks to their extensive training and specialized skills. Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs.

How much would I earn after taxes. The Central Board of Direct Taxes has recently notified how your EPF contribution over Rs 25 lacs in a financial year will be taxed. Great Jobs That Pay 90K or More.

You restructure salary so that the employer contribution comes down to Rs. How much would I earn after taxes. Distribution pays 0 self-employment tax.

118101 a year is how much per hour. The following steps allow you to calculate your salary after tax in Washington after deducting Medicare Social Security Federal Income Tax and Washington State Income tax. How much would I earn after taxes.

Your salary is going to cap out at 80-90K even after several years of exp. The best-paid 25 percent made 135220 that year while the lowest-paid 25 percent made 95730. The average lawyer salary in Australia is 118101 per year or 6056 per hour.

Entry-level positions start at 100000 per year while most experienced workers make up to 150000 per year. How to Calculate Salary After Tax in Washington in 2022. This basically depends on the companys salary structure lets go on this by the structure which most of the companies follow.

News this occupation seems to fly under some peoples radar. Any money left over after operating expenses retirement contribution and salary may be paid out in the form of a distribution. New Graduate Occupational Therapist Clinic-based role Multidisciplinary Team.

While all other supplemental wages are taxed at a flat rate of 66. How to Calculate Salary After Tax in Florida in 2022. These taxes will be reflected in the withholding from your paycheck if applicable.

This is the important part to understand as it will have a 125 contribution from your. How to Calculate Salary After Tax in California in 2022. To get the monthly In-hand salary nearest to the true value as a rule divide your CTC after removing bonus with 125 or 135 and by 12 or divide CTC here also remove bonus by 15 or 16.

Exterminators dont have to worry about taking work home to do after hours However this work isnt for everyone. Before tax thats an annual salary of 61828. The following steps allow you to calculate your salary after tax in Florida after deducting Medicare Social Security Federal Income Tax and Florida State Income tax.

Raphael Warnock D Ga has an unusual financial arrangement with an outside employer that allowed him to avoid income taxes on 89000 in outside salary last year according to tax experts. Census Bureau reported in September 2017 that real median household income was 59039 in 2016 exceeding any previous year. Chef de Partie - Banquets.

Mental Health Nurse Practitioner. If an estimated timeline for a decision is provided and after follow-up you still havent heard anything from the hiring manager its likely that the employer has moved on he explains. Earlier this 15 lacs would.

Certified Registered Nurse Anaesthetist. This 90k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Rhode Island State Tax tables for 2022. The avg salary in Chicago is at least 160K for a experienced IT 10 year professional in the private sector.

How Much Does A Small Business Pay In Taxes

How Much Would The Government Tax On A Canadian 300k Salary Quora

3

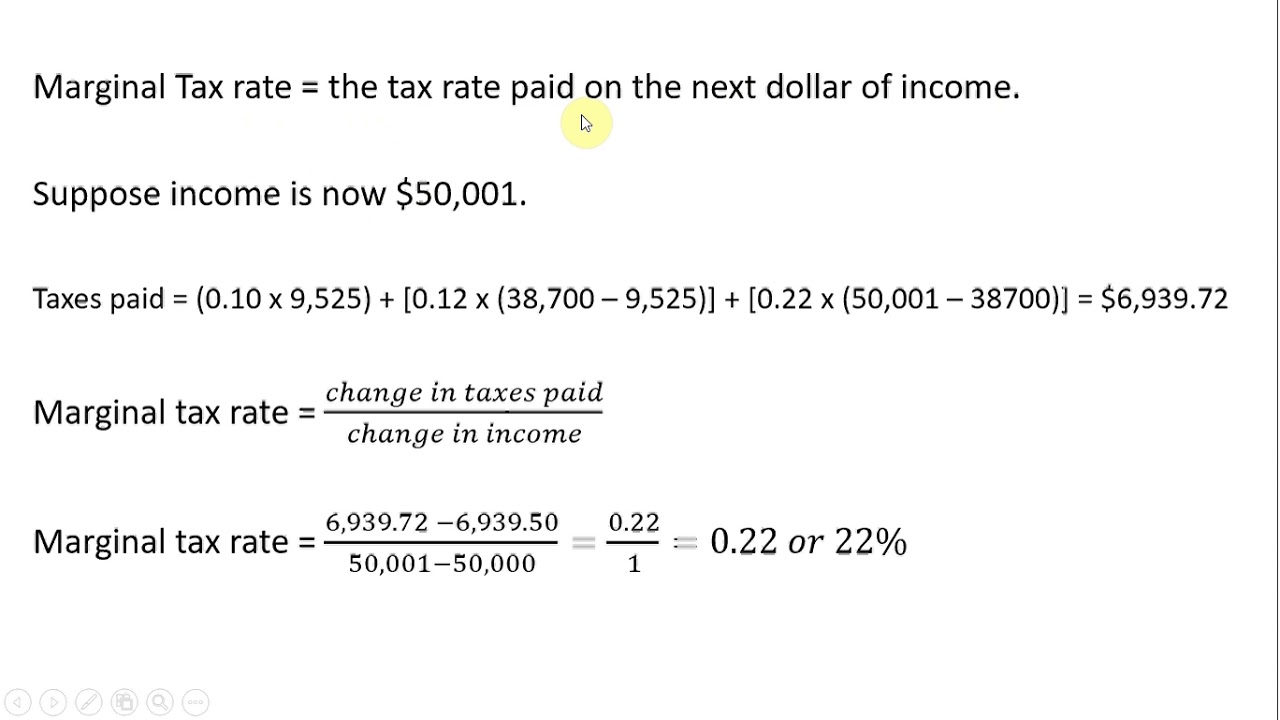

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

How Much Would The Government Tax On A Canadian 300k Salary Quora

90 000 After Tax Us Breakdown August 2022 Incomeaftertax Com

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Ontario Tax Brackets 2021

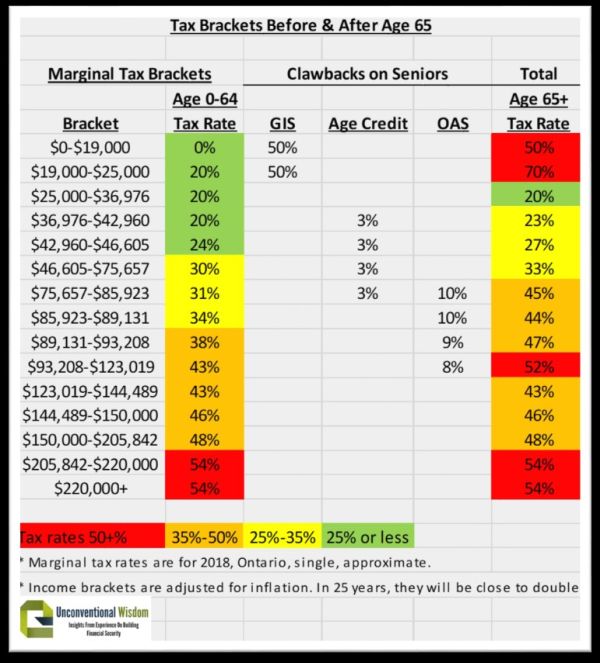

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The Game Of Life 50th Special Anniversary Edition Image Board Game Geek 06 10 17 Middle School Projects Life Board Game No Game No Life

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment S Corporation Income Tax Saving

1

2021 2022 Income Tax Calculator Canada Wowa Ca

New Job Make 90k Apparently I Need To Take An Extra 400 Month Off My Paycheck Otherwise We Ll Pay Taxes There S Gotta Be A Smarter Way Thoughts R Personalfinance

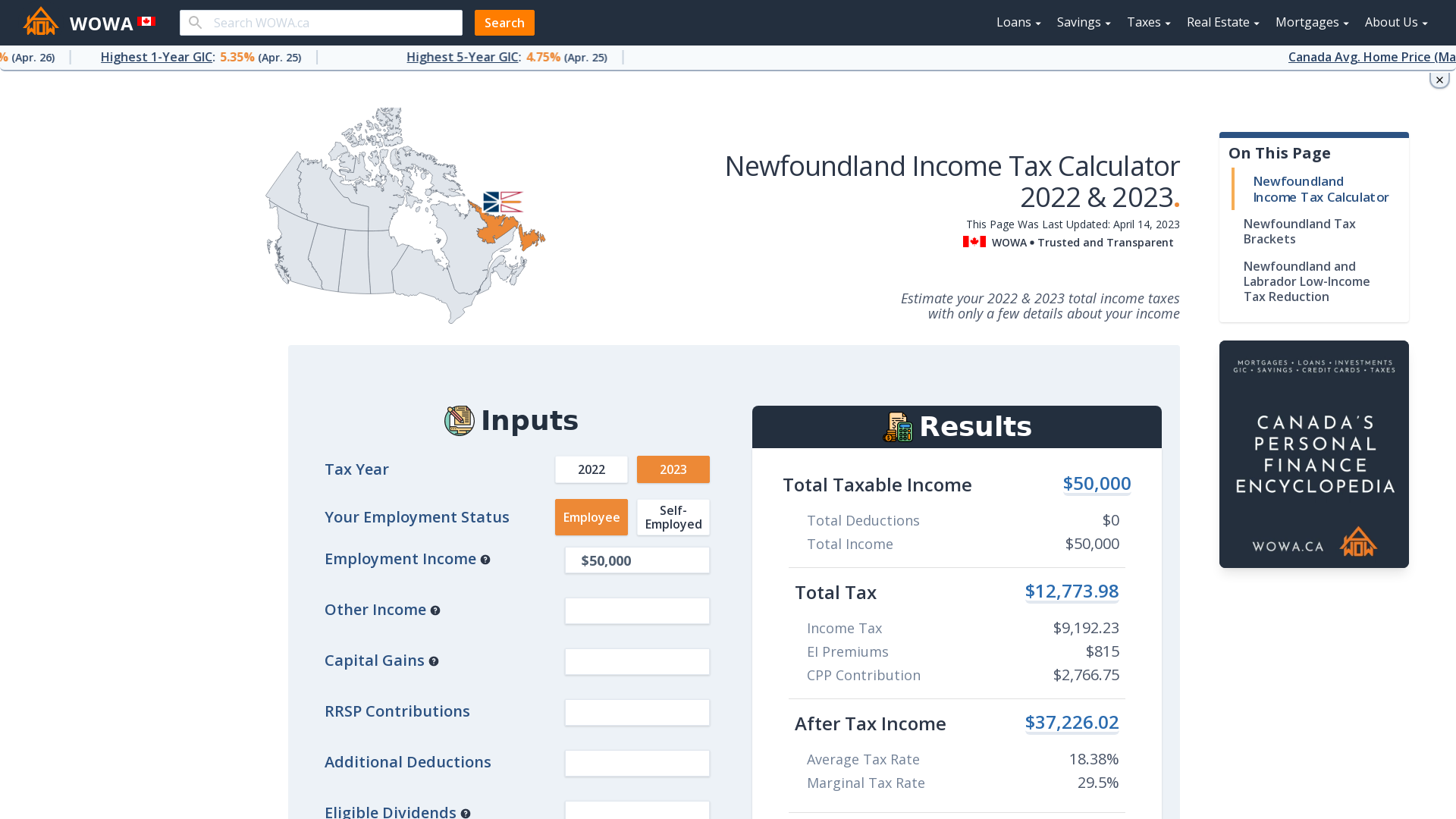

Newfoundland Income Tax Calculator Wowa Ca

3

90 000 A Year Is How Much An Hour Monthly Budget Breakout